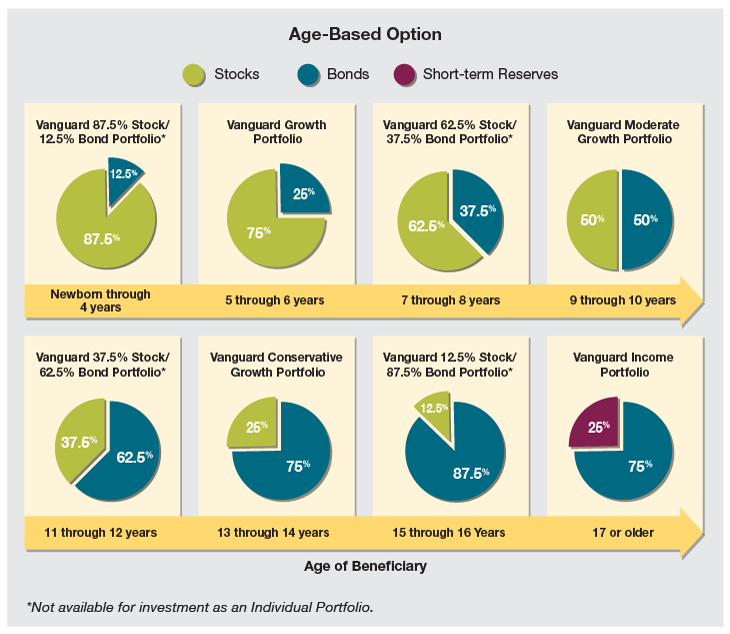

Web If youre under age 39 your portfolio is more likely to be heavily weighted towards stocks In fact this age group allocates nearly 90 of their. Web The New Life asset allocation recommendation is to subtract your age by 120 to figure out how much of your portfolio should be allocated. Web There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. Web The most important decision investors make is the mix of assets they select not the individual investments they purchase Asset mix should be based on an. Web Trend in asset allocation by participant age..

Different age groups different asset allocations. The old rule of thumb used to be that you should subtract your age from 100 - and thats the percentage of your portfolio. . ..

Result You can increase your wealth and meet your retirement goals by following these five best practices for. Result Get asset allocation examples for different age groups Learn how to set up a balanced portfolio based on an asset. The investment strategy you used in your 30s wont work in your 60s. Result Asset allocation refers to the ratio among different asset types in ones investment portfolio. Result Setting an asset allocation based on your age is a smart way to start planning for your retirement or building..

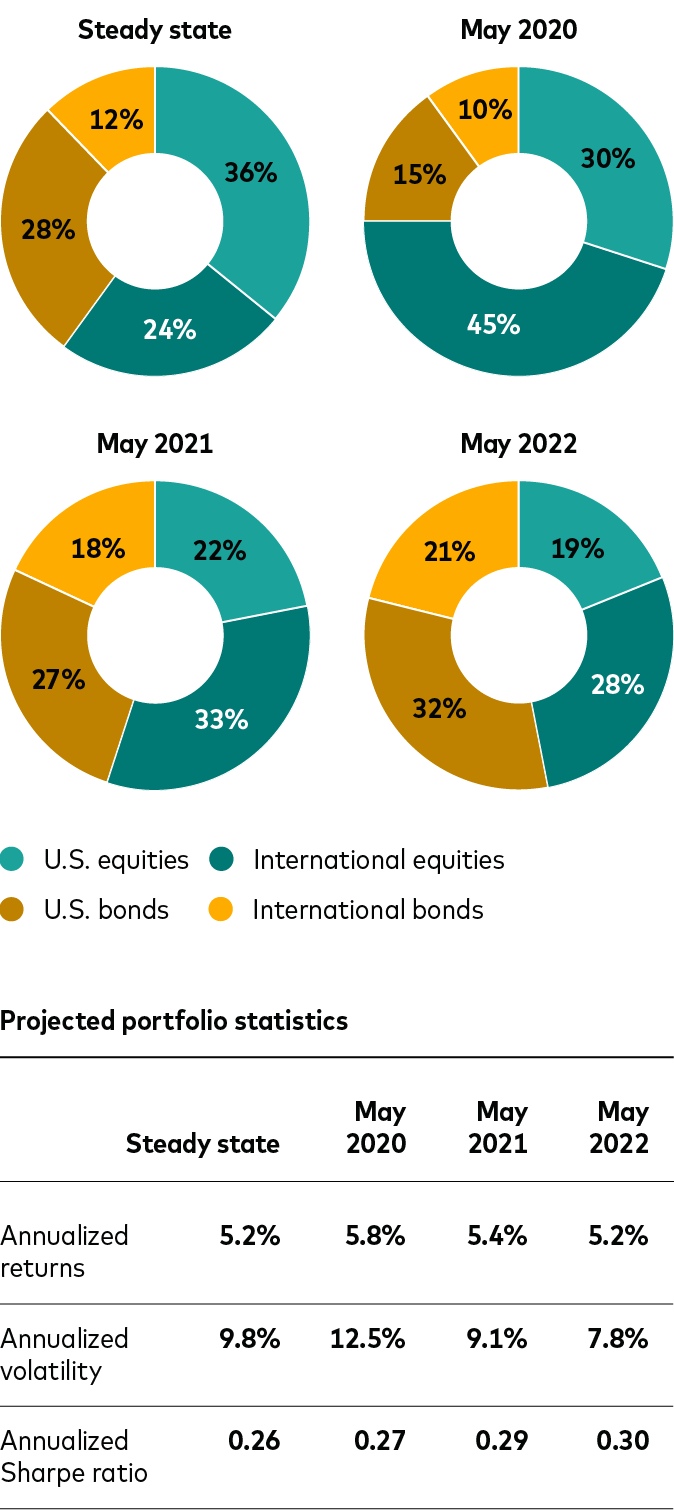

This method establishes and adheres to a base policy mixa proportional. Result Asset allocation refers to the mix of different investment assets you own. Result Allocating your investments among different asset classes is a key strategy to minimize your risk and. Result Asset allocation is how investors split up their portfolios among different kinds of assets. Asset allocation involves dividing an investment portfolio among different asset categories such..

Comments